I started this blog post in 2013, following a decision by Barclays Bank in the UK to close the accounts of Somali and other remittance companies. The problem has spread to other countries, most recently the US where on Friday 6 February 2015, the main bank providing services to Somali money transfer companies, Merchants Bank of California, closed their accounts.

Initially, the US-based Somali remittance companies suspended operations - but on 28 February they said they would restart operations, albeit in limited form. How will they do this? By carrying cash. I have highlighted the relevant part of the press release.

You can listen to some of my BBC interviews on the US crisis by clicking on the following links:

The BBC's Newshour

The BBC's Outside Source

The BBC's Newsroom programme

You can read my thoughts on why Somali remittances matter in this BBC online piece:

Somalis criticise US bank's move to halt remittances

On 19 February 2015, Adeso, Oxfam and the Global Centre on Cooperative Security launched a report on the remittance crisis, called Hanging by a Thread. I attended the launch in Chatham House in London - this is my BBC report:

My radio piece on the remittance report

You can read the report here: Hanging by a Thread

Whenever I want to send money from the UK to friends in Somalia, I go into a little shop on the high street, and hand my cash (or debit card) over to an agent for a Somali remittance company. The agent checks I am registered with the remittance firm (which I am), and checks that the intended recipient is also registered.

The agent prints me out a receipt and I leave the shop.

Within minutes (or occasionally a couple of hours), I receive a text message on my phone to say the money has been collected by my friend, even if he or she lives in a tiny village in Somalia. It is magically quick and reliable.

This system has also helped get my book into Somalia.

Shortly after the publication of Getting Somalia Wrong? Faith, War and Hope in a Shattered State, the sales manager at Zed Books called me in astonishment. She said a man from Mogadishu had phoned to ask her to send him some of my books to sell in his bookshop in Bakara market.

She told him it might be difficult, as she could not imagine how he would pay her for the books. He was living in a city that had been at war with itself for more than 20 years. The banking sector was virtually non-existent. He told her not to worry, he would get the money to her immediately.

Shortly after their conversation, the sales manager went around the corner from the office of Zed Books in north London. There she found a Somali remittance agent in an internet cafe. He gave her the cash for the books, which she packed into a box and sent by courier to Mogadishu. They were in the Bakara market bookshop within a few days.

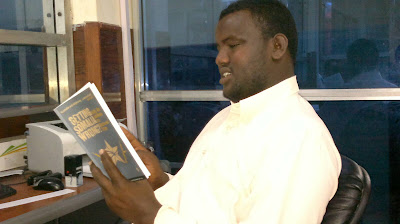

The bookseller sent me these photos of people in Mogadishu reading copies of my book after buying them from his shop:

In contrast, it took much longer for my publisher to send my books to Kenya. The process caused many bureaucratic headaches.

This efficient, reliable way of sending money in and out of Somalia is under threat. The remittance firms in the UK are finding it increasingly difficult to have bank accounts. Without a bank account, they lose their licence. Without a licence, they cannot operate, not only in the UK, but in most of the rest of Europe, Ethiopia and Kenya. One of the few banks that still provides money transfer companies with services in the UK is Barclays, which in May this year told all the Somali firms that it would close their accounts by July 10.

My personal story of how I use Somali money transfer firms to send money to friends, but also how they are used for business purposes, illustrates a much larger point. The hundreds of thousands of Somalis in the diaspora use these companies to send money home to relatives and friends. This money is a lifeline for millions. People use it to buy food and medicine, and to pay for education.

As Somalia has a virtually non-existent banking sector, money is sent in via remittance firms for investment purposes, and to rebuild and repair a country smashed up by more than two decades of conflict. Humanitarian and development agencies send vital assistance in via these firms. International organisations use them to pay local salaries.

This study was published in April 2012 by the US-based Centre on Global Counterterrorism Cooperation:

Capitalising on trust: Harnessing Somali remittances for counterterrorism, human rights and state-building

Media coverage

The crisis facing these companies generated a lot of media coverage. Here are a few examples:

BBC story: Barclays faces pressure from Somali cash transfer firms

The Guardian story: Somalis fear Barclays closure of remittance companies will cut lifeline

The Independent story: Red tape forces Barclays to stop UK Somali workers sending cash home

This article, published on the BizTech Africa website, is very comprehensive. It has lots of interesting quotes: Race is on to save UK-Somali remittance lifeline

Somali news websites are going big on the story. The title of this one caught my eye:

Somalis face an economic death penalty

Social media, including Facebook and Twitter are going wild. This doesn't surprise me at all. More than two decades of conflict, instability and drought have scattered Somalis to every corner of the earth. They make full and enthusiastic use of the internet, mobile phones (and remittance companies) to join themselves up, no matter where they are. They are post-modern, global nomads.

Somalis are also quick to mobilise, whether it is to fight or to talk. They have organised an e-petition that is fast filling up with signatures.

They have also set up a 'Somali Money Service Crisis' Facebook page

The decision by Barclays does not apply only to Somali remittance firms. The International Association of Money Transfer Networks says up to 250 companies, serving people from all over the world, have been affected.

I wonder if this company, which has a money transfer shop near my home, is one of those at risk:

On 24 June 2013, Barclays issued the following statement about its decision:

“It is recognised that some money service businesses don’t have the proper checks in place to spot criminal activity and could therefore unwittingly be facilitating money laundering and terrorist financing. We want to be confident that our customers can filter out those transactions, because abuse of their services can have significant negative consequences for society and for us as their bank. We remain very happy to serve the many companies who do have strong anti-financial crime controls. For the others which we can no longer bank, we regret the inconvenience that moving to another bank will cause.”

A few hours after Barclays issued the above statement, it sent me another one, which it said it had 'strengthened', referring to Somalia. Here is the later 'strengthened quote':

A similar move was made last year against Somali money transfer companies in the US state of Minnesota. Banks said they were worried about cash ending up in the wrong hands: BBC story on Somali remittance firms in USA

Following widespread protests by Somalis and pressure from others, a solution was eventually found to keep Somali remittances flowing from Minnesota, which is home to a large population of Somali migrants.

Here is a statement from the Somali Money Transfer Association in the UK:

Here is a letter signed by more than 100 academics and NGOS urging the British government to do something:

Initially, the US-based Somali remittance companies suspended operations - but on 28 February they said they would restart operations, albeit in limited form. How will they do this? By carrying cash. I have highlighted the relevant part of the press release.

Statement of the Somali American

Money Services Association.

Press

Release

February 28, 2015

Since Merchants Bank of California

terminated the accounts of Somali American Remittance Companies on February 6,

transmission of family support money to the needy Somali people in East Africa

grounded to a halt. Remittance companies lost the bulk of their wiring

capabilities and were forced to drastically scale down their services in many

states and completely shut down in many others.

For a long time, the Somali American Money

Services Association (SAMSA) had been reaching out to US regulators, elected

officials and other Government officials by warning of an impending

humanitarian crisis in the Horn of Africa if the un-banking of remittance companies

was not resolved. Unfortunately the situation appears to have come to the

precipice SAMSA and its advocates have been warning of. SAMSA wishes to convey

its utter disappointment that, at the moment, there is nearly no sustainable

channel to wire money to the desperately poor people of Somalia – unless

hundreds of millions of dollars a month are packed in suitcases and physically

transported across continents.

In recognition of the magnitude of the

problem, Members of the US House of Representatives and Senate met with the

State Department and Regulatory Agencies on February 26, 2015 in an effort to

find a solution to this critical problem. SAMSA wishes to express its dismay

that this high profile meeting could not identify a single possible short term solution

to this crisis. We wish to share not only our disappointment but our conviction

that there is surely a way to maintain this lifeline to the Somali people.

For SAMSA members, remittance is not just a

business; it is personal. We run a service that is the single most important

component of the Somali people’s livelihood. For millions across East Africa,

the $150-$200 a month remittance means the first and last line of defense

against starvation and homelessness. It is what ensures the children we left behind

continue to have food on the table. It is a vital bulwark against that next,

ever-looming man-made famine.

Considering the magnitude of the potential

humanitarian crisis, the Remittance Companies have resolved to resume their

services in a limited capacity on March 1, 2015, even if it is only possible

for a few weeks or months more with the unsustainable options that remain for

transporting money. The plan is to utilize the last remaining option available

to us (carrying cash abroad in person), no matter how unsafe or antiquated, to

deliver money until it, too, is no longer available. In all likelihood, this

desperate option will not last for more than a month or two, but it will be

worth it if we can prevent an avoidable, artificial famine even for a day

longer. Not only is this method too

costly and unsustainable, it also is likely to result in the loss of nearly 50%

of transmissions, as Money Transfer Companies will stop operating in many

regions due to the fact that it will be unrealistic to transport money from

them. We estimate that, with the limited capacity, these efforts will result in

the resumption of only about 50% of transmission volumes.

Meanwhile, SAMSA continues to believe in

the willingness of the United States, its regulatory Agencies and elected

officials to find a lasting solution to this problem. In Particular, US

Treasury and State Department cannot afford to continue taking this lightly. It

is our belief that the US Government does not intend for this money transfer

shutdown, or its inevitable humanitarian, economic, security and political

consequences, to transpire.

Finally, SAMSA wishes to appreciate the

efforts of elected Members of the US House of Representatives, Senate and the

Humanitarian Organizations that continue to advocate on behalf of the millions

of Somalis who face an uncertain future without remittances.

END

You can listen to some of my BBC interviews on the US crisis by clicking on the following links:

The BBC's Newshour

The BBC's Outside Source

The BBC's Newsroom programme

You can read my thoughts on why Somali remittances matter in this BBC online piece:

Somalis criticise US bank's move to halt remittances

On 19 February 2015, Adeso, Oxfam and the Global Centre on Cooperative Security launched a report on the remittance crisis, called Hanging by a Thread. I attended the launch in Chatham House in London - this is my BBC report:

My radio piece on the remittance report

You can read the report here: Hanging by a Thread

Sending money to Somalia: a personal experience

The agent prints me out a receipt and I leave the shop.

Within minutes (or occasionally a couple of hours), I receive a text message on my phone to say the money has been collected by my friend, even if he or she lives in a tiny village in Somalia. It is magically quick and reliable.

This system has also helped get my book into Somalia.

Shortly after the publication of Getting Somalia Wrong? Faith, War and Hope in a Shattered State, the sales manager at Zed Books called me in astonishment. She said a man from Mogadishu had phoned to ask her to send him some of my books to sell in his bookshop in Bakara market.

She told him it might be difficult, as she could not imagine how he would pay her for the books. He was living in a city that had been at war with itself for more than 20 years. The banking sector was virtually non-existent. He told her not to worry, he would get the money to her immediately.

Shortly after their conversation, the sales manager went around the corner from the office of Zed Books in north London. There she found a Somali remittance agent in an internet cafe. He gave her the cash for the books, which she packed into a box and sent by courier to Mogadishu. They were in the Bakara market bookshop within a few days.

The bookseller sent me these photos of people in Mogadishu reading copies of my book after buying them from his shop:

|

| People reading my book in Mogadishu. The bookseller bought my book from the publishers in London by sending money via a Somali remittance company. |

In contrast, it took much longer for my publisher to send my books to Kenya. The process caused many bureaucratic headaches.

A lifeline under threat

This efficient, reliable way of sending money in and out of Somalia is under threat. The remittance firms in the UK are finding it increasingly difficult to have bank accounts. Without a bank account, they lose their licence. Without a licence, they cannot operate, not only in the UK, but in most of the rest of Europe, Ethiopia and Kenya. One of the few banks that still provides money transfer companies with services in the UK is Barclays, which in May this year told all the Somali firms that it would close their accounts by July 10.

My personal story of how I use Somali money transfer firms to send money to friends, but also how they are used for business purposes, illustrates a much larger point. The hundreds of thousands of Somalis in the diaspora use these companies to send money home to relatives and friends. This money is a lifeline for millions. People use it to buy food and medicine, and to pay for education.

As Somalia has a virtually non-existent banking sector, money is sent in via remittance firms for investment purposes, and to rebuild and repair a country smashed up by more than two decades of conflict. Humanitarian and development agencies send vital assistance in via these firms. International organisations use them to pay local salaries.

Two in-depth reports on Somali remittances

This detailed study of remittances was published by the United Nations food agency, FAO, on 5 June 2013:

This study was published in April 2012 by the US-based Centre on Global Counterterrorism Cooperation:

Capitalising on trust: Harnessing Somali remittances for counterterrorism, human rights and state-building

Media coverage

The crisis facing these companies generated a lot of media coverage. Here are a few examples:

BBC story: Barclays faces pressure from Somali cash transfer firms

The Guardian story: Somalis fear Barclays closure of remittance companies will cut lifeline

The Independent story: Red tape forces Barclays to stop UK Somali workers sending cash home

This article, published on the BizTech Africa website, is very comprehensive. It has lots of interesting quotes: Race is on to save UK-Somali remittance lifeline

Somali news websites are going big on the story. The title of this one caught my eye:

Somalis face an economic death penalty

Social media, including Facebook and Twitter are going wild. This doesn't surprise me at all. More than two decades of conflict, instability and drought have scattered Somalis to every corner of the earth. They make full and enthusiastic use of the internet, mobile phones (and remittance companies) to join themselves up, no matter where they are. They are post-modern, global nomads.

Somalis are also quick to mobilise, whether it is to fight or to talk. They have organised an e-petition that is fast filling up with signatures.

They have also set up a 'Somali Money Service Crisis' Facebook page

It's not just Somali companies

The decision by Barclays does not apply only to Somali remittance firms. The International Association of Money Transfer Networks says up to 250 companies, serving people from all over the world, have been affected.

I wonder if this company, which has a money transfer shop near my home, is one of those at risk:

Barclays responds

“It is recognised that some money service businesses don’t have the proper checks in place to spot criminal activity and could therefore unwittingly be facilitating money laundering and terrorist financing. We want to be confident that our customers can filter out those transactions, because abuse of their services can have significant negative consequences for society and for us as their bank. We remain very happy to serve the many companies who do have strong anti-financial crime controls. For the others which we can no longer bank, we regret the inconvenience that moving to another bank will cause.”

A few hours after Barclays issued the above statement, it sent me another one, which it said it had 'strengthened', referring to Somalia. Here is the later 'strengthened quote':

“It is recognised that some money service businesses don’t have the proper checks in place to spot criminal activity and could therefore unwittingly be facilitating money laundering and terrorist financing. We want to be confident that our customers can filter out those transactions, because abuse of their services can have significant negative consequences for society and for us as their bank. We remain very happy to serve the many companies who do have strong anti-financial crime controls, including those who send money to Somalia. For the others which we can no longer bank, we regret the inconvenience that moving to another bank will cause.”

The American case

A similar move was made last year against Somali money transfer companies in the US state of Minnesota. Banks said they were worried about cash ending up in the wrong hands: BBC story on Somali remittance firms in USA

Following widespread protests by Somalis and pressure from others, a solution was eventually found to keep Somali remittances flowing from Minnesota, which is home to a large population of Somali migrants.

Reaction of Somali remittance firms

Here is a statement from the Somali Money Transfer Association in the UK:

·

The Horn of African communities face the

prospect of losing millions in remittance finance

following news that

Barclays is to withdraw banking services from up to 250 of Money Service Businesses

(MSBs) UK.

·

Barclays recently informed three-quarters of the

money-service companies that use its accounts

that it no longer wanted their custom – and gave them a very short notice to find alternative banking facilities by 10 July

2013. Barclays is the last UK bank that has

been providing services to the Somali

MSBs.

·

The Somali Money Services Association (SOMSA), a

UK trade body for the money transfer

industry, which has 17 members, has confirmed that 12 of its members have already lost their accounts with major

banks in the UK, including Barclays and HSBC. Five

others face imminent bank account closures.

·

The key issue is the damage to flows of cash to the vulnerable Somali

people, who depend on remittances for their

livelihood; and the likely threat of this action to economic and political stability in fragile parts of the Somali

region.

·

This action will have dire consequences in Somalia, where no

alternatives to the money service

businesses exist. The bank’s

decision to close the accounts of licensed and

regulated Somali MSBs could have the unintended consequence that money transfer might be pushed underground into the

hands of unlicensed, unregulated and illegal

providers.

·

The action of the banks will affect the many in the UK who send money

back home, as well as those who receive

it. It will also affect the international aid organizations, which

have no choice other than to use the licensed providers.

·

Financial institutions, including banks and MSBs, have understandable

concerns about money laundering. Its worth mentioning that the Somali MSBs

play a key role in the fight against

money laundering and work closely with all law enforcement agencies in the UK, including HMRC, FCA, SOCA

and other relevant authorities.

·

Undoubtedly, this action of the banks will deny the availability and

accessibility of the service to millions

of clients, in the Horn of Africa, including an unbanked majority

·

The Somali MSB industry is ready to work with the banks, regulators and

policy makers to resolve this matter.

·

SOMSA and its members, which are deeply concerned about the

negative impact that the bank’s action

will have on its valued clients, regret to share the gravity of this problem with all stakeholders, including the

clients and respectably seek their support in

resolving this matter. We request

our valued clients to join us in our appeal to the banks and the UK government authorities to reconsider this decision

and find a fair and durable solution to

this unfolding humanitarian crisis.

The academics' letter

Here is a letter signed by more than 100 academics and NGOS urging the British government to do something:

EMBARGOED UNTIL 24 JUNE 2013 00:01

24 June 2013

Mr Mark Simmonds MP

Parliamentary Under Secretary of State for Africa

Foreign and Commonwealth Office

King Charles Street

London SW1A 2AH

Dear Mr Simmonds,

We are writing to request that the UK Government works with

British banks to find a durable solution to the recent decision of Barclays to

close its accounts with Somali Money Service Businesses (MSBs). Some have already been closed, and the

account of Dahabshiil, by far the largest MSB providing services to Somalia, is

to be closed as of July 10. With such a short timeframe, and without having

provided a comprehensive explanation as to why Barclays wishes to sever its

relationships with the MSBs, these companies are understandably finding it very

difficult to find new partners to work with.

What is at stake is a lifeline that provides essential

support to an estimated 40% of the population of Somalia. Somali MSBs provide

fast, reliable and long trusted transmission of funds from the diaspora

(estimated at approximately 1.5 million people) to their relatives at home. In

addition, many other diaspora groups from the Horn of Africa – in Ethiopia,

Kenya and South Sudan – send remittances to their family members using the same

companies.

We are a group of researchers and aid practitioners who

regularly engage with the Somali and/or African Diaspora – indeed some of us

are ourselves members of that population – and we have seen firsthand the

impact that remittances have on preserving the resilience of individuals and

communities in the Horn of Africa. Some of us have done in-depth research on

the uses of remittance funds. In one such recent study, 73% of remittance

recipients said that they use the money they receive from their relatives

(averaging $2040 per year) to pay for basic food, education, and medical

expenses. One-third of recipients said that they would not be able to afford

basic food if the remittances were stopped. Moreover, one-quarter of recipients

said that they receive support from a single relative living in the UK.[1]

Not only do Somali MSBs provide essential services to the

global Somali community, they also make it possible for international

humanitarian and development organisations to provide vital support to Somalis

in a country that lacks a more formal public banking system and where war and

famine are recurrent visitors. Most of the large relief and development

organisations, including the United Nations Development Programme, Oxfam, CARE,

and others, use Somali MSBs to pay their staff, procure assistance, and even in

some cases to facilitate distribution of cash payments to food-insecure

households as part of their cash-for-work schemes. During the famine of 2011,

diaspora organisations in the UK, as well as throughout Europe, North America

and elsewhere raised millions of dollars in relief assistance, channelling it

through MSBs to provide fast and effective life-saving support. All of these

activities will be imperilled if Somali MSBs are forced to suspend their

operations.

We understand that in recent years there has been a concern

about funds going to support individuals and groups who have been designated as

terrorists. We think that the best way to work to avoid this is to promote

responsible, transparent, and accountable systems in line with existing

regulations and Know-Your-Customer standards, rather than by closing down the

channels by which funds are sent; this action will only encourage people to

send funds through illegal, unsafe, and untraceable channels, thereby

potentially making the problem of support to proscribed parties much more

serious.

We call on the UK Government to:

-

Assist the Somali MSBs

in finding alternative banking partners, and to assemble the necessary

compliance information needed to demonstrate their accountability to new

partners

-

Request that Barclays

extends its termination deadline for at least 6 months for Somali MSBs so that

the flow of remittances through licensed companies is not disrupted, and a more

durable solution can be found in the meantime

-

Convene a series of

multi-stakeholder discussions, beyond Whitehall, that will work on developing

the enhanced due diligence that the banks seem to require for this sub-sector

of MSBs

In your speech at the Barclays Africa Forum on June 20, you

spoke about the need to promote trade and investment in Africa, and the

importance of Britain’s role in that process. This position, together with the

welcome commitment of the UK government to promote Somalia’s recovery as

indicated in the May 2013 London Conference on Somalia, underscores the

importance of a resolution of this issue.

As academics, researchers, and people involved in assisting

Somalia through relief and development we would be pleased to provide any

information we may have that can help to educate people about the remittance

industry and the impact of remittances on Somali livelihoods. Please direct any correspondence with

signatories of this letter to laura.hammond@soas.ac.uk.

Yours

sincerely (listed alphabetically),

1.

Abdi Aynte, Director,

Heritage Institute for Policy Studies, Mogadishu. Somalia

3.

Abdihakim Aynte,

Independent Researcher, Mogadishu, Somalia

4.

Abdikarin

Adan, SPA Wales

5.

Abdulkhaliq Khalif,

MSc African Studies Candidate, St Anne’s College, University of Oxford, UK

6.

Abdurahman Abdullahi (Baadiyow),

Chairman of the Board of Trustees, Mogadishu University, Mogadishu, Somalia

7.

Abdurahman Sharif, Coordinator, BOND CT

sub-group, UK

8.

Amina Daud, SOS

Somali, London, UK

9.

Amina Wehelie, Somali

Forum, Luton, UK

10.

Amun Osman,

Independent, Mogadishu, Somalia

11.

Anab Nur, Heritage

Institute for Policy Studies, Mogadishu, Somalia

12.

Anja Simonsen, PhD

Candidate, University of Copenhagen, Denmark

13.

Dr Anna

Lindley, Lecturer, Dept of Development Studies, SOAS-University of London, UK

14.

Anna Rader, PhD

Candidate, SOAS-University of London

15.

Ayan Mohamed, Kaydh

Arts Centre, Co-Director, Hargeisa International Book Fair, London, UK

16.

Dahir Hassan, CEO,

Somali Research and Education Network (SomaliREN), Nairobi, Kenya

17.

David Brooks, Somali Society, UK

18.

Dr Ceri Oeppen,

Lecturer in Geography, Sussex University, UK

19.

Dr Edwina Thompson, Independent

Expert, Beechwood International, London, UK

20.

Dr Hany el Banna OBE, Trustee, Muslim Charities

Forum, founder Islamic Relief, London, UK

21.

Dr Mark Bradbury, Rift

Valley Institute, Nairobi Kenya & London, UK

22.

Dr Michael Walls,

Lecturer, Development Planning Unit, University College London, UK

23.

Dr Nicholas Van Hear,

Senior Researcher, Centre on Migration Policy and Society, University of Oxford, UK

24.

Dr Simon Addison,

Research Associate, Centre of Migration and Diaspora Studies, SOAS-University

of London, UK

25.

Edna Adan Ismail, Edna Adan University Hospital,

Hargeisa. Anglo-Somali Society, Hargeisa, Somaliland

26.

Edward Paice, Africa

Research Institute, London, UK

27.

Ellen De Keyser,

Consultant Researcher, UK

28.

Emma Lochery, DPhil

Candidate, Dept of Politics, University of Oxford, UK

29.

Fadumo Dayib,

Director, African Diaspora Policy and Development Hub, UK

30.

Farhan Hassan,

Executive Director, Somali Heritage Academic Network (SHAN) Ltd. , London, UK

31.

Dr Francesca Declich,

Fulbright Research Scholar, Stanford University, USA

32.

Prof Georgi Kapchits,

Somali Linguist & Radio Journalist, Moscow, Russia

33.

Hamish

Wilson, Degmo Centre For Somali Heritage & Rural Life, UK

34.

Hannah Elliot, PhD Candidate, Centre of African

Studies, University of Copenhagen, Denmark

35.

Dr Hannah Vaughan-Lee,

SOAS-University of London, UK

36.

Harbi Farah, Council

of Somali Organisations, UK

37.

Huda Ismail, Halwo

Crafts, London, UK

38.

Hugh Walker, retired, BBC Somali Service, Anglo-Somali

Society, UK

39.

Ibrahim Abikar Noor,

PhD Candidate, Evaluation Studies, University of Minnesota, USA

40.

Ibrahim Farah,

University of Nairobi, Kenya

41.

Idil Ahmed, United for

Somali Students, UK

42.

Idil Osman, PhD

Candidate, University of Cardiff, Wales

43.

Dr Iginio Gagliardone,

Oxford Centre for Media Studies, UK

44.

Jacob Wiebel, DPhil

Candidate in History, St Cross College, University of Oxford, UK

45.

Jama Musse Jama,

Co-Director, Hargeisa International Book Fair, Pisa, Italy

46.

James Cockayne, PhD

Candidate, Kings College London, UK

47.

James Shaw-Hamilton, Director, The Humanitarian

Forum, London, UK

48.

James Smith,

Independent Consultant/Researcher, Nairobi, Kenya

49.

Jason Mosely,

Associate, Africa Programme, Chatham House, London, UK

50.

Dr Jean

Bowyer, Consultant Paediatrician, UK

51.

Dr Jill Rutter,

Research Manager, Daycare Trust, UK, UK

52.

Julianne Weis, DPhil

Candidate, History of Medicine, Wellcome Unit for the History of Medicine,

University of Oxford, UK

53.

Dr Katarzyna Grabska,

Associated Research Fellow, Global Migrations Programme, Graduate Institute of

International and Development Studies, Geneva, Switzerland

54.

Keith Virgo, Anglo-Somali Society, UK

55.

Khadar Ahmed Abdi,

Consultant & Lecturer, Hargeisa University, Somaliland

56.

Dr Laura Hammond,

Senior Lecturer in Development Studies, SOAS-University of London, UK

57.

Dr Laura Mann,

Researcher, Oxford Internet Institute, University of Oxford, UK

58.

Laura Sampath, Global

Training Programs Manager, National Collegiate Inventors and Innovators

Alliance (NCIIA), Boston MA, USA

59.

Magnus Taylor,

Journalist focused on East Africa, London, UK

60.

Dr Marta Bivand Erdal, Senior Researcher, Peace

Research Institute of Oslo (PRIO), Norway

61.

Dr Martin Orwin, Dept

of Languages, SOAS-University of London, UK

62.

Dr Maryann Bylander,

Senior Teaching Fellow, Dept of Development Studies, SOAS-University of London,

UK

63.

Matt Bryden, Director,

Sahan Research, Nairobi, Kenya

64.

Dr Michael Collyer,

Lecturer in Geography, University of Sussex, UK

65.

Mohamed Ahmed Ali

(Medeshi), Independent

66.

Mohamed Hassan, PhD

Candidate, Goldsmiths College, UK

67.

Mohamed Sharaf Hassan,

Masters candidate in International Development, University of Birmingham, UK

68.

Mohammed Fadal,

Founder, Somaliland Research and Development Institute (SORADI), Hargeisa,

Somaliland

69.

Mustaf Ibrahim, Tower Hamlets Somali

Organisations Network, London, UK

70.

Dr Naohiko Omata,

Research Officer, Refugee Studies Centre, University of Oxford, UK

71.

Dr Nasir Warfa, Senior

Lecturer & Deputy Director, Wolfson

Institute of Preventive Medicine, Queen Mary, University of London, UK

72.

Dr Nauja Kleist,

Danish Institute of International Studies, Copenhagen, Denmark

73.

Dr Neil Carrier,

African Studies Centre, University of Oxford, UK

74.

Dr Nicole Stremlau,

Oxford Centre for Media Studies, UK

75.

Nimo-Ilhan Ali, PhD

Candidate, SOAS-University of London, UK

76.

Dr Nisar Majid,

Independent Consultant and Dept of Politics, University of Bristol, UK

77.

Nuur Mohamud Sheekh,

Programme Coordinator, Nairobi Forum, Rift Valley Institute, Nairobi, Kenya

78.

Dr Oliver Bakewell,

Co-Director, International Migration Institute, University of Oxford, UK

79.

Omer

Ahmed, Anglo-Somali Society, UK

80.

Prof Abdi Samatar,

Geography, University of Minnesota, USA

81.

Prof Barbara E. Harrelll-Bond, OBE, Emerita

Professor & Senior Associate, Refugee Studies Centre; Honorary Fellow, Lady

Margaret Hall, University of Oxford, UK

82.

Prof Christopher

Clapham, Centre of African Studies, University of Cambridge, UK

83.

Prof Christopher M.

Cramer, Political Economy & Development, SOAS-University of London, UK

84.

Prof David M.

Anderson, African History, University of Warwick, UK

85.

Prof JoAnn McGregor,

Geography, University College London, UK

86.

Prof Ken Menkhaus,

Political Science, Davidson College, UK

87.

Prof Lidwien

Kaptjeins, Kendall/Hodder Professor of History & Chair, History Dept and

Middle Eastern Studies Programme, Wellesley College, Wellesley, MA USA

88.

Prof Marja Tiilikainen,

Visiting Professor, Dept of Anthropology, University of Toronto, Canada

89.

Prof Peter Little,

Chair of Anthropology, Emory University, Atlanta, GA, USA

90.

Prof Roger Ballard,

Director, Centre for Applied South Asian Studies, UK

91.

Rakiya Omaar, Rift

Valley Institute, Nairobi Kenya and London, UK

92.

Dr Richard Reid, Dept

of History, SOAS-University of London, UK

93.

Robin

Le Mare, Anglo-Somali Society, UK

94.

Roger Middleton,

Senior Programme Manager, Somalia Conflict Dynamics International, Nairobi,

Kenya

95.

Safia Aateeye, Somali Forum, Luton, UK

96.

Safia Yahy, AMEB

Mother and Child Care, UK

97.

Sagal Osman, Good

Effort for Health and Well-being, London, UK

98.

Sahra Abdullaahi, Somali Forum Luton, UK

99.

Saynab Mahamud, Hawa’s

Haven, London, UK

100.Dr

Sebastiana Etzo, Researcher, Centre of African Studies, University of London,

UK

101.Siham

Rayale, PhD Candidate, SOAS-University of London, UK

102.Tuemay Aregawi, AML/CFT Researcher, Addis

Ababa, Ethiopia

103.Zakia

Hussen, Researcher, Heritage Institute for Policy Studies, Mogadishu, Somalia

104.Zaynab

Warsame, C Galool, Home of Somali Education, UK

Cc:

Mr David Lewis,

Head of Anti-Money-Laundering and Terrorist Finance Policy and Sanctions and

Illicit Finance, HM Treasury

Mr Daniel

Fearn, Head of Somalia Unit, Foreign and Commonwealth Office

Ms Claire Innes, Private Sector Development Team, DFID

Mr Antony

Jenkins, Group Chief Executive, Barclays plc

Ms Catharine

French, Chief of Staff, Barclays plc

Somali Money

Services Association (SOMSA)

Somali American

Money Services Association (SAMSA)

[1] See

FAO/FSNAU. June 2013. ‘Family Ties: Remittances and Livelihoods Support in

Puntland and Somaliland,’ www.fsnau.org. See

attached for other publications that we have been involved with as researchers

and authors.

I wondered how the British government would react to the letter, especially as Britain has set itself up as a great friend of Somalia, hosting two international conferences on the country in the past two years, and otherwise taking the lead in many of the initiatives to help Somalia recover.

I understood they had a meeting on 24 June 2013 to discuss the problem, specifically in relation to Somalia. I asked for a statement and received one from a British foreign office spokesperson on the evening of 24 June. It was rather brief:

It is interesting that on 20 June 2103 the Africa minister, Mark Simmonds MP, gave a speech at the Barclays Africa Forum. He focussed on the importance of government and business working together to build prosperity for Africa (and for Britain).

He described Barclays as "a bank that has been operating in Africa for over a century... better placed than most to provide insights into the many opportunities that the continent offers".

He also said, "the UK has a lot to offer to support Africa's rise. We have expertise and skills in sectors from the financial services and the knowledge economy to oil and gas, green energy, agriculture and infrastructure. These are all areas in which British firms can add value that would benefit Africa in the long term".

You can read the full speech here: Mark Simmonds' speech at the Barclays Africa forum

Senait Gebregziabher, The Somalia country director for the Oxfam charity - which uses a Somali remittance firm to send aid to Somalis - on June 25 issued this statement:

In some conversations I have had about the Somali remittance crisis, I have been told that Somalis have 'nothing to worry about' because money transfer companies unaffected by Barclays' decision operate in Somalia, with dozens of branches. The firm most frequently mentioned was Western Union. So I decided to send money to a friend in Somalia via Western Union.

I went to Brixton in South London, a vibrant area where lots of migrants live and shop. I was amazed by the incredible number of money transfer shops in the area. I had never noticed them before, even though I visit Brixton regularly.

I went into a Western Union shop. This one was above a pharmacy on the high street, the counter tucked away at the back of an art supplies shop on the second floor. I was told nobody was available to serve me, and that I should come back in five to ten minutes time.

I decided to continue my walk down the high street. I passed loan shops, gold shops, mobile phone shops. immigration lawyers (lots of them), criminal lawyers (lots of them - especially near Brixton police station - some offered 24 hour services).

I came to a little mall called 'Latin Boulevard'. It advertised two Somali remittance firms, a barbers, a Nigerian money transfer company, and a hairdressers.

It was very dark inside. At the back, I found a shop with signs written in an Ethiopian or Eritrean script (I think - please correct me if I am wrong) and pictures of British passports. It was closed.

I asked the Nigerian remittance agent - who was busy with a customer and had a Nigerian flag flying in his small shop - where the Somali remittance firms were. He told me to ask the barber. The barber - who was shaving someone's head - directed me to a tiny shop selling jewellery, abayas and incense. The man inside told me he was an agent for the Somali money transfer firm, Kaah Express.

I asked him how much it would cost me to send $200 to the Somali town of Burao (which is where I had recently sent money to a friend). He said the fee was $10. He asked who I wanted to send the money to. When I told him my friend's name, he said 'I know him'. He then described my friend's height, character and job. He was definitely speaking about the right person.

I then walked back to Western Union.

I told the agent I wanted to send £50 to Somalia. She gave me a form to fill out. I chose the 'send the money in minutes' option. The agent told me the fee to send the money was £4.90.

I asked her if Western Union had an agent in Burao, which is a large city. She tapped on her computer for some time. She started to frown at the screen. She then went to the back and got out a big book, like a telephone directory. I could see her flicking through the pages in a confused way, coming and going between the 'South Africa' pages. I said I wanted to send money to 'Somalia', not 'South Africa'. But Somalia was not in the directory.

She became irritated with me, saying I should have checked all of this beforehand, as she had already entered my details into the system. I said I didn't want to send money to Somalia if I didn't know to where it was going. She then tried to phone Western Union but couldn't get through. I tried too, but was put on hold for so long that I gave up.

Luckily I had not handed over the money. I left the shop and went home.

The following morning (June 27) I got up early and called Western Union. I got through to a very helpful lady in Manila, The Philippines.

I told her I wanted to send money to Burao in Somalia, but first wanted to check the locations of Western Union agents there. She asked for my name, and kept saying "Thank you so much for waiting so patiently Miss Mary", as it took her several minutes to search the system.

Eventually she told me Western Union had no agents in Somalia who dealt with money transfers made over the phone. She said there was one agent who accepted cash transfers, but that I would have to go to a Western Union outlet to send the money. She told me this agent was in Hargeisa (the capital of the self-declared republic of Somalia). She gave me his address, which is Global Export and Import, Jigjiga Yar, Hargeisa.

She said Western Union used to have an agent in the Somali capital, Mogadishu, but that he/ she was no longer operating.

She said there were no other Western Union agents anywhere else in Somalia.

The Somali president speaks

The British government's reaction

I understood they had a meeting on 24 June 2013 to discuss the problem, specifically in relation to Somalia. I asked for a statement and received one from a British foreign office spokesperson on the evening of 24 June. It was rather brief:

“We can confirm that the Minister for Africa received a letter from Laura Hammond of the School of Oriental and African Studies on 24 June. We will reply to the letter in due course.”

The Africa minister speaks at the Barclays Africa forum

It is interesting that on 20 June 2103 the Africa minister, Mark Simmonds MP, gave a speech at the Barclays Africa Forum. He focussed on the importance of government and business working together to build prosperity for Africa (and for Britain).

He described Barclays as "a bank that has been operating in Africa for over a century... better placed than most to provide insights into the many opportunities that the continent offers".

He also said, "the UK has a lot to offer to support Africa's rise. We have expertise and skills in sectors from the financial services and the knowledge economy to oil and gas, green energy, agriculture and infrastructure. These are all areas in which British firms can add value that would benefit Africa in the long term".

You can read the full speech here: Mark Simmonds' speech at the Barclays Africa forum

Oxfam makes a statement

Senait Gebregziabher, The Somalia country director for the Oxfam charity - which uses a Somali remittance firm to send aid to Somalis - on June 25 issued this statement:

“In recent years, more and more banks have been refusing to process money transfers to Somalia, making it more difficult for Somalis to send money home. We recognize that banks are concerned money could be laundered or used by extremist groups. But we are also deeply concerned about the effects that these account closures will have on innocent families who depend on the money. As long as there is due diligence, money transfers should be allowed to continue. If they are stopped, the resulting humanitarian fall out will be too great, and many more Somali families would fall back into crisis.

Soon to be published research supported by Oxfam, suggests that Somali migrants in the UK send over £100 million per year back to Somalia as remittances, which provide an essential lifeline for families in need in Somalia. This money is used for basic necessities such as food and health care, as well as for children’s education. Somalia still has at least one million people still reliant on humanitarian aid. Banks need to review and negotiate with the authorities and regulators to clarify processes so vital funds can continue to flow.”

On the evening of June 26, Britain's Channel 4 television put on its website a film by the journalist, Jamal Osman, about the Somali remittance crisis. The piece was broadcast on Channel 4 TV on June 27. Barclays told Jamal Osman it had had a change of heart, at least for one Somali money transfer company, by offering it an extension.

Here is Jamal's report: Somali families' lifeline under threat

I contacted Barclays to confirm the extension. They said that they have indeed extended the deadline for the Somali remittance firm, Dahabshiil -- by 30 days.

Barclays changes its position (a bit)

On the evening of June 26, Britain's Channel 4 television put on its website a film by the journalist, Jamal Osman, about the Somali remittance crisis. The piece was broadcast on Channel 4 TV on June 27. Barclays told Jamal Osman it had had a change of heart, at least for one Somali money transfer company, by offering it an extension.

Here is Jamal's report: Somali families' lifeline under threat

I contacted Barclays to confirm the extension. They said that they have indeed extended the deadline for the Somali remittance firm, Dahabshiil -- by 30 days.

The United Nations speaks

This is what the UN said on 26 June:

U.N. HUMANITARIAN COORDINATOR IN SOMALIA CONCERNED OVER POTENTIAL IMPACT OF BARCLAYS DECISION

- The United Nations Resident and Humanitarian Coordinator for Somalia expressed concern on Wednesday about the potential impact of the decision of Barclays Bank to terminate the accounts of Somali money service companies.

- Philippe Lazzarini said that, while we understand the banking industry’s motivation to be compliant in monitoring funds, this is part of a worrying trend that risks cutting a lifeline of essential services for Somali people.

- He added that a huge number of Somalis rely on remittances from relatives in the diaspora to pay for basic needs such as food, education and health care. One-third of recipients said that they would not be able to afford basic food if the remittances were stopped.

- Estimates indicate that at least $1.2 billion in remittances is transferred to Somalia every year, which is more than the entire UN humanitarian assistance programme.

The experiment

I went to Brixton in South London, a vibrant area where lots of migrants live and shop. I was amazed by the incredible number of money transfer shops in the area. I had never noticed them before, even though I visit Brixton regularly.

|

| Brixton remittance shop |

|

| Western Union adverts were much in evidence, advertising 'new, lower fees'. |

I went into a Western Union shop. This one was above a pharmacy on the high street, the counter tucked away at the back of an art supplies shop on the second floor. I was told nobody was available to serve me, and that I should come back in five to ten minutes time.

I decided to continue my walk down the high street. I passed loan shops, gold shops, mobile phone shops. immigration lawyers (lots of them), criminal lawyers (lots of them - especially near Brixton police station - some offered 24 hour services).

I came to a little mall called 'Latin Boulevard'. It advertised two Somali remittance firms, a barbers, a Nigerian money transfer company, and a hairdressers.

It was very dark inside. At the back, I found a shop with signs written in an Ethiopian or Eritrean script (I think - please correct me if I am wrong) and pictures of British passports. It was closed.

I asked the Nigerian remittance agent - who was busy with a customer and had a Nigerian flag flying in his small shop - where the Somali remittance firms were. He told me to ask the barber. The barber - who was shaving someone's head - directed me to a tiny shop selling jewellery, abayas and incense. The man inside told me he was an agent for the Somali money transfer firm, Kaah Express.

I asked him how much it would cost me to send $200 to the Somali town of Burao (which is where I had recently sent money to a friend). He said the fee was $10. He asked who I wanted to send the money to. When I told him my friend's name, he said 'I know him'. He then described my friend's height, character and job. He was definitely speaking about the right person.

I then walked back to Western Union.

I asked her if Western Union had an agent in Burao, which is a large city. She tapped on her computer for some time. She started to frown at the screen. She then went to the back and got out a big book, like a telephone directory. I could see her flicking through the pages in a confused way, coming and going between the 'South Africa' pages. I said I wanted to send money to 'Somalia', not 'South Africa'. But Somalia was not in the directory.

She became irritated with me, saying I should have checked all of this beforehand, as she had already entered my details into the system. I said I didn't want to send money to Somalia if I didn't know to where it was going. She then tried to phone Western Union but couldn't get through. I tried too, but was put on hold for so long that I gave up.

Luckily I had not handed over the money. I left the shop and went home.

The following morning (June 27) I got up early and called Western Union. I got through to a very helpful lady in Manila, The Philippines.

I told her I wanted to send money to Burao in Somalia, but first wanted to check the locations of Western Union agents there. She asked for my name, and kept saying "Thank you so much for waiting so patiently Miss Mary", as it took her several minutes to search the system.

Eventually she told me Western Union had no agents in Somalia who dealt with money transfers made over the phone. She said there was one agent who accepted cash transfers, but that I would have to go to a Western Union outlet to send the money. She told me this agent was in Hargeisa (the capital of the self-declared republic of Somalia). She gave me his address, which is Global Export and Import, Jigjiga Yar, Hargeisa.

She said Western Union used to have an agent in the Somali capital, Mogadishu, but that he/ she was no longer operating.

She said there were no other Western Union agents anywhere else in Somalia.

The Somali president speaks

The president of Somalia, Hassan Sheikh Mohamud, issued the following statement on June 27:

PRESIDENT HASSAN: REMITTANCES ARE A LIFELINE FOR SOME OF THE WORLD’S POOREST

Mogadishu, 27 June 2013.

H.E. Hassan Sheikh Mohamud, President of the Federal Republic of Somalia, has called on Barclays Bank to suspend its decision to shut down the accounts of crucial Somali cash transfer firms.

The President said: “Some of the world’s poorest people depend on remittances sent to them from the Somali diaspora. At the end of the vast majority of cash transfers supported by Barclays Bank, are families and children whose struggle through each day is unimaginable to most.

“Somalia is on the brink of a breakthrough after two decades of chaos. We have the support of Britain and the world and we need the support of all our friends across all sectors. Barclays are a friend and we cannot understand their sudden decision to foreclose on legitimate accounts that support money transfer.

“I appeal to Barclays to reverse their decision, or at least to postpone it to allow proper consultation. A solution must be in place before such drastic action is taken.

The President hopes that a way can be found for Barclays Bank to retain the service whilst working together with the Somali and UK Governments to remain compliant in monitoring transfer funds and improving procedures that tackle financial crime, a stated commitment of the new Federal Government.

“We understand Barclay’s corporate responsibility and its duty to its global customers to maintain a reputation for tackling financial crime, but that does not have to pull the rug from under the feet of people battling extreme poverty and before our fledgling government can step in to help.

“We need time and support from the UK Government to resolve this issue, or the sad reality is that an “regrettable inconvenience” could directly result in human tragedy.”

ENDS

For further information please contact Abdirahman Omar Osman (Eng. Yarisow),

Senior Advisor & Spokesperson to the Office of the President,

engabdirahman@gmail.com +252 615 479911 or +252 699 998854

Please follow us on Twitter: @thevillasomalia - and on Facebook: The Villa Somalia (State House of Somalia)

A visit to Barclays

On the morning of June 28, I visited the headquarters of Barclays in London's business district, Canary Wharf.

These were the first things I saw when I entered the posh foyer:

The same slogans were on the doors of the lifts, which went up more than 30 floors.

|

| A lift door at Barclays' headquarters in London |

|

| The view from the 30th floor was spectacular |

A new statement from Barclays

Shortly after my visit from Barclays, they sent me an updated statement. Here it is:

"As a global bank, we must comply with the rules and regulations in all the jurisdictions in which we operate. The risk of financial crime is an important regulatory concern and we take our responsibilities in relation to this very seriously.

"It is recognised that some money service businesses don’t have the proper checks in place to spot criminal activity and could unwittingly be facilitating money laundering and terrorist financing. Abuse of their services can have significant negative consequences for society and for us as their bank. We remain happy to serve companies who have strong anti-financial crime controls, but are asking the others to find another bank. This is solely about the company’s controls, not where they send money to.

“We are speaking with remittance industry bodies to support them in finding a solution for global remittances given the regulatory and financial crime pressures upon them. In the meantime, to assist customers find alternative banking services, we have given them double the normally permitted time, and will extend this where it is appropriate to do so.”

FOR IMMEDIATE RELEASE

Ms Ali started the meeting by saying remittances far eclipse aid in terms of the amount of money sent to poorer parts of the world. She warned "if this industry is damaged, there are consequences for millions". She said the money transfer industry needed to "be strengthened, not destroyed... we cannot end up with this industry collapsing, and developing countries suffering a catastrophe".

She said it was unacceptable that the remittance companies were being labelled "guilty until proven innocent".

She said she was organising a campaign on the issue, had asked Barclays for a meeting with MPs, and that she wanted a debate in parliament.

A man from the UK Money Transmitters Association said he had been to see Barclays who told him the decision to close the bank accounts of remittance companies was for commercial reasons.

The Economic Secretary to the Treasury, Conservative MP, Sajid Javid, said the Treasury "was aware" of the situation. He said the Treasury was trying to come up with proposals to make the banks happy, but that it was "ultimately a commercial decision".

The Somali campaigner, Ayan Mohamud, stood up and said if the Somali remittance companies were closed, money would be sent to Somalia by dodgy means.

Ms Ali suggested one possible solution would be to set up a remittance bank or other 'special status institution', perhaps with the help of the Department for International Development (DFID). There was a round of applause when she said the diaspora in the UK were good at innovating.

The MP for East Ham, Stephen Timms, who met Barclays, said on the one month extension granted to companies who asked for it: "I didn't leave the meeting (with Barclays) with any great hope that the solution would be permanent unless the UK government does something".

The MP for Cardiff West (lots of Somalis live in Cardiff), Kevin Brennan, said it would be "a criminal act for some small and medium size businesses run by ethnic minorities to be put to the sword because of the situation".

A Somali charity worker said "the Somali famine would be nothing compared to this crisis".

There was then some confusion as Ms Ali was told she had to end the meeting because another one was due to start. She thought she had the room for a bit longer, but told everybody to stay seated as, by a stroke of luck, the International Development Secretary, Justine Greening, was coming to the next meeting. Ms Ali then ambushed Ms Greening on the remittance issue. Ms Greening looked somewhat uncomfortable as she was forced to make a comment. She said she was "looking at the issue in terms of DFID".

Everybody had to leave the room, but nobody wanted to stop the meeting, so Ms Ali led us along the corridors, into a tunnel, and up the other side of the road into Portcullis House. She found a spare room, and discussions continued. Ms Ali gave an interview to the journalists in the room:

Here is part of her interview (it wouldn't upload - I will keep trying):

I then left Portcullis House and headed for a nearby bus stop. I couldn't help noticing the advert on the side of the first bus that pulled up:

Later I went to my local supermarket. Guess who was advertising there too?

Unintended consequences

The petition

Al Jazeera - http://www.aljazeera.com/video/europe/2013/08/20138716169972543.html

Reuters - http://www.trust.org/item/20130807160042-yk6uo/?source=hpeditorial

Press Association - http://www.thisisguernsey.com/business/city-news/2013/08/07/bank-must-keep-lifeline-for-poor-2/

BBC News - http://www.bbc.co.uk/news/business-23598832 (audio) http://www.bbc.co.uk/news/business-23600749

BBC Radio 4 Today programme (audio) - http://www.bbc.co.uk/programmes/b037v4f3

Times - http://www.thetimes.co.uk/tto/business/industries/banking/article3836955.ece

Financial Times - http://www.ft.com/cms/s/0/f0eb197e-ff4d-11e2-8a07-00144feabdc0.html#axzz2bMohpj46

Guardian - http://www.theguardian.com/global-development/shortcuts/2013/aug/07/sending-money-home-barclays-transfer?INTCMP=SRCH

Guardian (Comment) - http://www.guardian.co.uk/commentisfree/2013/jul/15/barclays-money-transfer-agents

Independent - http://www.independent.co.uk/news/business/news/mo-farah-backs-campaign-to-save-barclays-money-transfer-service-8749157.html

Evening Standard - http://www.standard.co.uk/news/london/mo-farahs-appeal-over-money-lifeline-8750078.html

Channel 4 News - http://www.channel4.com/news/mo-farah-barclays-remittance-somalia-cash-transfer-video

CNN - http://edition.cnn.com/video/data/2.0/video/business/2013/08/08/pkg-boulden-uk-banks-somalia.cnn.html

BBC Afrique - http://www.bbc.co.uk/afrique/region/2013/08/130807_somalie_mo_farah_transfert.shtml

The Economist - http://www.economist.com/news/middle-east-and-africa/21581995-western-worries-about-money-laundering-are-threatening-economic-lifeline

Oxfam report - http://www.oxfam.org/en/policy/keeping-somalia-lifeline-open

After the petition was delivered, a big meeting was held on the issue. Rushanara Ali attended. This is what she said:

DFID's position

Another interesting article

http://www.mondato.com/en/articles/barclays-somalia-bitcoin-seeking-digital-remittance-alternatives

"It is recognised that some money service businesses don’t have the proper checks in place to spot criminal activity and could unwittingly be facilitating money laundering and terrorist financing. Abuse of their services can have significant negative consequences for society and for us as their bank. We remain happy to serve companies who have strong anti-financial crime controls, but are asking the others to find another bank. This is solely about the company’s controls, not where they send money to.

“We are speaking with remittance industry bodies to support them in finding a solution for global remittances given the regulatory and financial crime pressures upon them. In the meantime, to assist customers find alternative banking services, we have given them double the normally permitted time, and will extend this where it is appropriate to do so.”

A statement from Shuraako

--For Immediate Release--

“Somali Money Transfer Services Disruption”

“Somali Money Transfer Services Disruption”

Friday, June 28, 2013

Recently, some global financial institutions have announced that they will withdraw their support from Somalia’s money transfer (SMT) businesses, citing insufficient checks in place to prevent criminal activities including money laundering and terrorist financing. Shuraako and our partner global investors are deeply concerned by this development, and the consequences they will have for foreign investment and job creation in Somalia.

SMTs are a lifeline for the Somali economy; they support household consumption and lay the groundwork for Somalia’s development and reconstruction. Each year $1-1.5 billion in remittances are sent by the Somali diaspora through SMTs.i These funds exceed international humanitarian assistance, which were approximately $612 million in 2012.ii Most remittances pay for basic household expenses. In a recent survey by the UN Food and Agriculture Organization, a third of Somalis interviewed reported that a disruption of SMTs would prohibit them from accessing food, medicine, and education.iii SMTs also serve organizations working in the region such as the United Nations and other large, international nongovernmental organizations like Oxfam and Save the Children among others.iv

Somalia’s stability has increased in recent months, and the country appointed a central government in September 2012. The continued regional stability depends crucially on economic development and reconstruction. It is imperative to protect the livelihoods of those Somalis who are dependent on remittances.

Shuraako’s own efforts to connect promising business opportunities with investors are impacted by the news that money transfers to Somalia will be interrupted. We will continue to closely follow these developments and report on them on our website.

In addition, Shuraako hosts a collection of reports on Somali remittances at http://shuraako.org/remittances-industry-analyses-and-news. For more information please contact Shuraako’s social and digital media specialist, Jean-Pierre Larroque at jplarroque@shuraako.org.

__________

Shuraako is a self-funded, non-profit initiative working to promote investment into promising business models and social enterprises in Somalia. Shuraako believes that job creation fosters stability and peace, and is key to rebuilding Somalia. We believe that developing the business sector generates financial and social revenues. Shuraako also aims to help facilitate and coordinate ongoing efforts that support trade, investment and other economic development efforts in Somalia.

i Cockayne, J., & Shetret, L. (2012). Capitalizing on trust harnessing somali remittances for counterterrorism, human rights and state building. Ministry of Foreign Affairs of Denmark.

ii United Nations Office for the Coordination of Humanitarian Affairs, (2013). Consolidated appeal: Somalia 2012 table d (Table ref: 32Sum). Retrieved from Financial Tracking Service website: http://fts.unocha.org

iii Food and Agriculture Organization of the United Nations, Food Security and Nutrition Analysis Unit- Somalia. (2013). Family ties: remittances and livelihoods support in puntland and somaliland. Nairobi: United Nations Somalia, Ngecha Campus.

iv Dahabshiil. (2013). Dahabshiil story. Retrieved from http://www.dahabshiil.com/about-us/dahabshiil- story.html

Somalis write a letter

Indorsed by more than 180 civil society and advocates for social justice and human rights groups in Somalia/Somaliland

FOR IMMEDIATE RELEASE

July 1st, 2013

URGENT APPEAL: Call FCO to keep flow of the Somali remittances flowing from Britain

To: H.E. David Camaroon

UK Prime Minister

To: Mr Mark Simmonds MP

Parliamentary Under Secretary of State for Africa

Foreign and Commonwealth Office

King Charles Street

London SW1A 2AH

To: Mr Neil Wigan

UK Ambassador to Somali

Dear Prime Minister,

We, the undersigned, the pro-democratic movements including advocates for social justice and human rights groups in Somaliland/Somalia, wish to express our deep concerns to the recent decision of British Bank of Barclays to close its accounts with Somali Money Service Businesses (MSBs). Some have already been closed, and the account of ‘Dahabshiil’ the largest MSB providing services to Somalia, by far, is to be closed soon.

At least 10 million Somalis – many in need of urgent lifesaving assistance – face a potential cut-off of aid from abroad from family members as the UK bank plans to close money-wiring services next month. The key issue is the damage to flow of cash to the vulnerable Somali people, who depend on remittances for their livelihood; and the likely dire consequences the move shall have on Somalis and Somalia, where no alternatives to the money service businesses exist.

The Somali/Somaliland civil society groups, Human Rights Defenders and Pro-democracy Movements’ strongly believe that the Barclays bank service is a major lifeline for Somalis and is the only one offering this service. UK based Somali Diaspora face being left without any means to help their families survive through the current humanitarian crisis.

We, the Somali/Somaliland civil society groups, Human Rights Defenders and Pro-democracy Movements’ are highly praised the leading role taken by UK government to help rebuild Somalia, on the other hand, we are seriously worried, that without the services of these money transfer organizations, Somalis living in the diaspora throughout the UK and Europe will not be able to send desperately needed support home to their relatives. This will have immediate and severe humanitarian implications and the Barclays’ decision to cease its financial wiring services with MBS to Somalia will only encourage people to send funds through illegal, unsafe, and untraceable channels, thereby potentially making the problem of support to proscribed parties much more serious, and more worse it may have negative impact to efforts provided by the world community for stabilizing and development of the country.

We are joining the appeal sent to UK Government and Barclays leaders by the President of Federal Government of Somali H. E. Hassan Sheikh Mohamoud, who said “Some of the world’s poorest people depend on remittances sent to them from the Somali diaspora. At the end of the vast majority of cash transfers supported by Barclays Bank, are families and children whose struggle through each day is unimaginable to most. We need time and support from the UK Government to resolve this issue, or the sad reality is that an “regrettable inconvenience” could directly result in human tragedy.”

We are argue the Somali Community in UK to come together and work with the elected officials and Barclays bank authorities to resolve this matter effectively. Remittance businesses are the financial lifelines for millions of Somalis struggling to cope with the world’s worst humanitarian crisis in 60 years and decades of civil conflict. An estimated $2 Billion Dollars—one third of the annual Gross Domestic Product (GDP) of Somalia and more than the annual donor contributions is channeled to Somalia through remittances by Somalis in the Diaspora to support their relatives back home. Closing remittances will alienate and marginalize Somalis in the Diaspora and their needy families inside and outside Somalia.

We humbly – and most sincerely - request the UK Government to keep Somali remittances flowing from UK, which is home to a large population of Somali migrants..

CC:

- Nicholas Kay, Special Representative of the Secretary-General (SRSG) for Somalia,

- Mr David Lewis, Head of Anti-Money-Laundering and Terrorist Finance Policy and Sanctions and Illicit Finance, HM Treasury

- Mr Daniel Fearn, Head of Somalia Unit, Foreign and Commonwealth Office

- Ms Claire Innes, Private Sector Development Team, DFID

- Mr Antony Jenkins, Group Chief Executive, Barclays plc

- Ms Catharine French, Chief of Staff, Barclays plc

- Hectors Sants, Head of Compliance, Barclays plc

Yours sincerely

This petition was indorsed by following civil society and human rights organizations groups operating in Somalia/Somaliland, civil society and human rights groups.

(The signatories list)

SOMALILAND IMPARTIAL HUMAN RIGHTS GROUPS

| ||

1.

|

Horn of Africa Human Rights Watch Committee (HORNWATCH)

| |

2.

|

Activist Network for Disabled Persons (ANDP)

| |

3.

|

Ubah Social Welfare Organization (USWO)

| |

4.

|

Disable Children Association (DCA)

| |

5.

|

Somaliland Youth Voluntary Organization (SOYVO

| |

6.

|

Barako Women Organization (BARAKO)

| |

7.

|

United Togdheer Women Umbrella (UNITA)

| |

8.

|

Togdheer Youth Voluntary Organization (TOGOYOVO)

| |

9.

|

Naaso-Hablood Handicap Association (NAHA)

| |

10.

|

Daami Youth Development Organization (DAYDO)

| |

11.

|

Welfare Tumaal Organization (WAAB)

| |

12.

|

Tumaal Development Foundation (TDF)

| |

13.

|

Women Minority Organization (ISIR)

| |

14.

|

Somaliland Culture and Sport Association (SOCSA)

| |

15.

|

Somaliland Journalist Association (SOLJA)

| |

16.

|

Community concern Somalis (CCS)

| |

17.

|

Saaxil Handicap Organisation (SHO)

| |

18.

|

Voluntary Youth Organization (VAYS)

| |

SOMALILAND UNIVERSITIES

| ||

19.

|

University of Hargeisa

| |

20.

|

Amoud University

| |

21.

|

Berbera Marine University

| |

22.

|

University of Burao

| |

23.

|

University of Erigavo

| |

24.

|

Golis University

| |

25.

|

Admas University

| |

MEMBER ORGANISATIONS OF NAGAAD WOMEN UMBRELLA

| ||

26.

|

Agriculture Development Organization (ADO)

| |

27.

|

Alkownin Women Voluntary Organization (ALKOWNIN)

| |

28.

|

Agriculture Rehabilitation and Women in Development (ARWO)

| |

29.

|

Association for the Somaliland Women's Advancement (ASWA)

| |

30.

|

Aw Barkhadle Women Development Organization (AWDO)

| |

31.

|

Ayaan Women's Development Association (AYAAN)

| |

32.

|

Barwaaqo Lakulan Women Association (BAKWA)

| |

33.

|

Barwaqo Voluntary Organization (BVO)

| |

34.

|

Candlelight for Health and Education (CLHE)

| |

35.

|

Committee for Concerned Somalis (CCS)

| |

36.

|

Dareen Rural Relief & Development (DAREEN)

| |

37.

|

Dulmar for Women's Development Advocacy and Peace (DULMAR)

| |

38.

|

Female-Headed Households Association (FEDHA)

| |

39.

|

Hanad Women's Welfare Association (HWWA)

| |

40.

|

Hargeisa Voluntary Youth Committee (HAVAYOCO)

| |

41.

|

Hargeisa Women's Group (HAWO-GROUP)

| |

42.

|

Hargeisa Women on Focus Organization (HAWFO)

| |

43.

|

Mother Land Rescue Group (MRG)

| |

44.

|

Lama-Huraan Women's Association (LMWA)

| |

45.

|

Somaliland Women's organization (SOLWO)

| |

46.

|

Somaliland War Widow Organization (SWWO)

| |

47.

|

Somaliland Women's Development Association (SOWDA)

| |

48.

|

Somaliland Women's Research and Action Group (SOWRAG)

| |

49.

|

Somaliland for Progress, Advocacy and Peace (SOWPO)

| |

50.

|

Somaliland Young Women's Association (SOYWA)

| |

51.

|

Tawakal Women & Children's Organization (TAWAKAL)

| |

52.

|

Voluntary National Youth Organization (VONYO)

| |

53.

|

Women's Action for Advocacy and Development Association (WADA)

| |

54.

|

Women's Rehabilitation and Development Association (WORDA)

| |

55.

|

Women Inter-Action Group (WIAG)

| |

56.

|

Women's Action Advocacy and Progress Organization (WAAPO)

| |

SOMALILAND NATIONAL DISABILITY FORUM

| ||

57.

|

Somaliland Handicap Association (SHA)

| |

58.

|

Nasa-Hablod Handicap Association (NAHA)

| |

59.

|

Hargeisa Youth Development Association (HADYA)

| |

60.

|

Hargeisa Deaf School (HDS)

| |

61.

|

Activist Network for Disabled Persons (ANDP)

| |

62.

|

Orthohope Rehabilitation Center (ORC)

| |

63.

|

Disability Action Network (DAN)

| |

64.

|

Hargeisa School For Special Needs (HSSN)

| |

65.

|

Disabled Children Association (DCA)

| |

66.

|

Hargeisa Handicap Association (HHA)

| |

67.

|

Tawakal Women’s Association (TAWAKAL)

| |

68.

|

Albustan Handicap Association (AHA)

| |

69.

|

Hargeisa Handicap Women (HHW)

| |

70.

|

Somaliland Blind Society (HABS)

| |

71.

|

Youth Development Disability Organization (YODDO)

| |

72.

|

Somaliland Red Crescent Society (SRCS)

| |

73.

|

Borama Deaf and Blind School (BD&BS)

| |

74.

|

Sahil Handicap Organization (SHO)

| |

75.

|

Tawakal Lifeline Organization (TLO)

| |

76.

|

Erigavo Handicap Organization (EHO)

| |

77.

|

Las-anod Handicap Association (LHA)

| |

NON MUSLIM RELIGIOUS GROUPS IN SOMALILAND

| ||

78.

|

Somaliland Catholic Church

| |

NAFIS NETWORK MEMBER ORGANIZATION

| ||

79.

|

Candlelight

| |

80.

|

HAVAYOCO

| |

81.

|

Alkownin

| |